Area homeowners may want to open their mailboxes carefully in November. Truth-in-taxation statements likely will bring sticker shock with rising home values and property taxes.

St. Paul, Ramsey County and St. Paul Public Schools officials released information on 2022 property values and 2023 estimated taxes for median market value homes in St. Paul’s 17 planning districts and suburban communities, during a meeting of the Joint Property Tax Advisory Committee on Sept. 28.

A caveat is that taxes can vary greatly from property to property, and can be affected by comparable sales in an area and by physical improvements or property damage. But the look at a neighborhood’s median value home is an indicator of what may be to come.

Countywide, aggregate estimated market values are at an all-time high, which continued strong growth due to strong demand and low supply of houses. But that raises red flags about a widening affordability gap.

The trends are worrisome for elected officials. County Commissioner Victoria Reinhardt noted that the median cost of living in Ramsey County exceeds the median income. County commissioners are asking that the joint committee do more to look at how to bring costs of government down, especially the costs of maintaining debt loads.

TAX BURDEN SHIFTING TO HOMES

Of all types of property in St. Paul and Ramsey County, home values have risen the most, said Corey Erickson, interim deputy county assessor. But that means more of a shift in property tax burden to homeowners and apartment building owners, and less pain for commercial and industrial property owners. For example, the average apartment building owner will see a 6.5 percent property tax increase. Commercial property taxes on average would go up just 1.3 percent.

The median market value home in all of St. Paul is at $266,300 for taxes payable in 2023. That’s up from last year’s value of $228,700. Increases due to tax shifts are at $235, with further potential increases of up to $271 with the various maximum levies. That’s a $506 or 14.8 percent increase, from $3,418 to $3,924.

Local officials are promoting property tax rebate and homestead credit programs for several neighborhoods, including homeowners in Frogtown and Hamline-Midway. St. Paul City Council members are already looking at ways to trim down the 15.34 percent levy increase proposed by Mayor Melvin Carter. (See related story.)

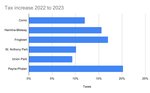

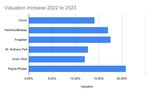

In area neighborhoods, Frogtown saw the greatest median market value increase for 2022 and property taxes payable in 2023. The median home value rose from $170,300 to $200,100, a 17.5 percent hike. Property taxes would increase from $2,412 this year to $2,821 next year, a 17 percent hike.

The median value home in Hamline-Midway is close behind, with a 17 percent increase from $210,000 to $254,600. Property taxes on this median value home would rise 15.6 percent, from $3,097 to $3,579.

Como’s median value home rose from $258,200 to $294,700, a 14.1 percent increase. Property taxes would rise from $3,927 to $4,397, a 12 percent increase.

St. Anthony Park’s median home value rose 12.7 percent, from $328,500 to $370,200. Property taxes would increase 10.1 percent, from $5,139 to $5,656.

The Union Park neighborhoods of Merriam Park, Lexington-Hamline and Snelling-Hamline see a median value increase of 12 percent, from $342,300 to $383,500. Property taxes would increase $5,377 to $5,878 or 9.3 percent.

The highest median market value increase for taxes payable 2023 is Payne-Phalen at 20.8 percent, from $194,500 to $234,900. Property taxes would increase 20.2 percent, from $2,859 to $3,104.

The only neighborhood seeing a market value decrease is downtown, when the median value home dipped 1.2 percent, from $188,700 to $186,400.

A look at value trends from 2018 and 2022 is striking. The neighborhood citywide with the greatest change is Dayton’s Bluff, where the median value rose from $130,500 in 2018 to $214,700 in 2022, an increase of 64.5 percent.

Monitor area neighborhoods saw varying impacts over that time, with Frogtown seeing the greatest increase of median value at 57.1 percent. The median value home was at $129,200 in 2018 and is $203,000 in 2022.

Hamline-Midway median values increased from $177,900 in 2018 to $242,100 in 2022, for a hike of 36.1 percent. Close behind are the Como median values, increasing from $219,900 in 2018 to $296,850 in 2022, an increase of 35 percent.

St. Anthony Park’s median home value rose 30 percent over that time period, from $348,800 in 2018 to $453,500. The Merriam Park-Lexington-Hamline-Snelling-Hamline neighborhoods had a median value increase of 26.8 percent, from $300,900 in 2018 to $381,400 in 2022.

Looking at the city as a whole the smallest median value increase was seen in Highland Park. From 2018 to 2022, the median value home there rose 21.6 percent, from $327,250 to $398,050. Values in Highland and other neighborhoods held strong during the recession more than a decade ago, and that’s reflected in the recent trends.

Comments

No comments on this item Please log in to comment by clicking here